When England beat Germany 2-0 in a June 2021 European Championship match, it was a major upset. But in the Washington Post, writers Karla Adam and Loveday Morris suggested that there was more at work than just luck. “England views Germany as one of its biggest rivals,” they wrote. “But it doesn’t apply so much the other way around, with German fans focused on other more tightly fought European rivalries.”

When Stanford professor Riitta Katila read that article shortly after the match, the idea that the outcome of a competition could be impacted by how rivals view each other — or whether they consider their counterpart a serious rival at all — made perfect sense. In fact, it lined up with a new research paper she had just published with Sruthi Thatchenkery, her former PhD student and now an assistant professor at University College London.

“It’s the perception that can really be a differentiator,” says Katila. “It might matter who you think is your competitor.”

In that research, the two professors examined how firms in the highly competitive enterprise software industry thought about each other, and how those competitive dynamics related to new product introductions. Just as athletic competition drives individual athletes to new heights, they observed, business competition can (not too surprisingly) drive technological leaps. However, as in sports, the mere existence of competitors doesn’t necessarily boost an organization’s performance. Instead, Katila and Thatchenkery found clear evidence that the most innovative firms tended to be the ones that were paying attention to the right competitors.

“It’s the perception that can really be a differentiator,” says Katila. “It might matter who you think is your competitor.”

The most simplistic model of business competition looks something like this: Company A and Company B both produce Widget X. The primary ways they compete with each other are by seeking out lower-cost materials and labor, and by engaging in R&D to improve their products. Because of that competition, consumers end up with better products at lower prices.

On the other hand, what if Company B decides to innovate in a more radical way, and creates a new and improved solar-powered Widget Z that renders Widget X obsolete?

Once you introduce radical innovation, competitive dynamics become much more complicated. The ultimate source of innovation is nearly impossible to pin down, and the sheer number of failed high-profile startups demonstrates that innovation isn’t simply a function of the amount of VC funding invested multiplied by the pedigree of the management team. Why did Company B, rather than Company A, envision and create the game-changing Widget Z? Executives from those companies would probably give dozens of different answers.

However, by examining this question from an empirical rather than anecdotal lens, Katila and Thatchenkery hoped to reduce the noise and surface some clear data. To do that, they conducted deep interviews with 21 prominent executives who were active in the enterprise software industry between 1995 and 2012, asking those executives who they viewed as their main competitors. How did they identify competitors? How did they keep track of competitors? What mistakes did they think they had made related to perceived competitors?

In addition, Katila and Thatchenkery amassed a comprehensive dataset of 8,502 new software product introductions during that same time period, and constructed detailed competition relationships, taking advantage of publicly available 10-K forms filed by 121 enterprise software firms.

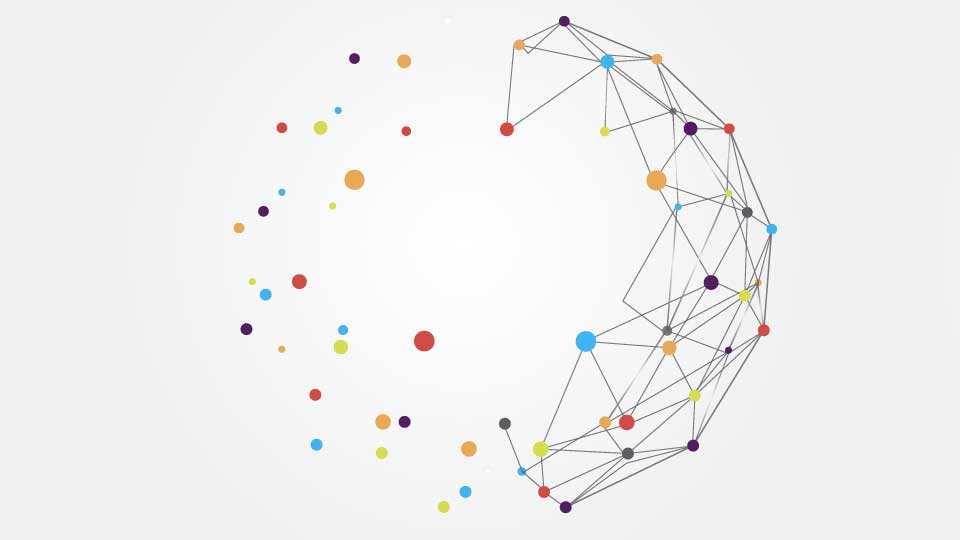

In their paper, Katila and Thatchenkery refer to a firm’s mental map of its competitive landscape as its competition network. (If you need more academic precision, they define a competition network as “a relational structure that emerges from aggregation of a firm’s perceptions of its relevant competitors rather than symmetric relationships defined by market overlap.”)

The most innovative teams…tended to view competitors in creative and even unusual ways.

Katila and Thatchenkery found that particular approaches to competition networks resulted in increased product introductions. The most innovative teams, it turns out, tended to view competitors in creative and even unusual ways.

“Overall, to find novelty, firms should look to the frontiers of the competition network, not the well-worn middle,” Katila says.

To make the importance of this sort of competitive modeling more concrete, Katila and Thatchenkery point to the competitive dynamics between software rivals Cyberguard and Axent. “Although both faced the same objective competitors in their product markets, Axent had a unique view of competition,” they write. While Cyberguard mostly paid attention to obvious rivals, Axent was paying attention to more peripheral competitors. In the end, it turned out that Axent was able to introduce new products at a fast pace, while Cyberguard struggled to launch new products and scaled more slowly.

One significant implication of their research is that leaders and technology innovators may have much to gain from being more intentional and explicit when it comes to mapping their competitive landscape.

If you’re Germany, in other words, you might benefit from paying more attention to a team like England.